Data-Driven, Back-Tested, Risk-Based Position Sizing

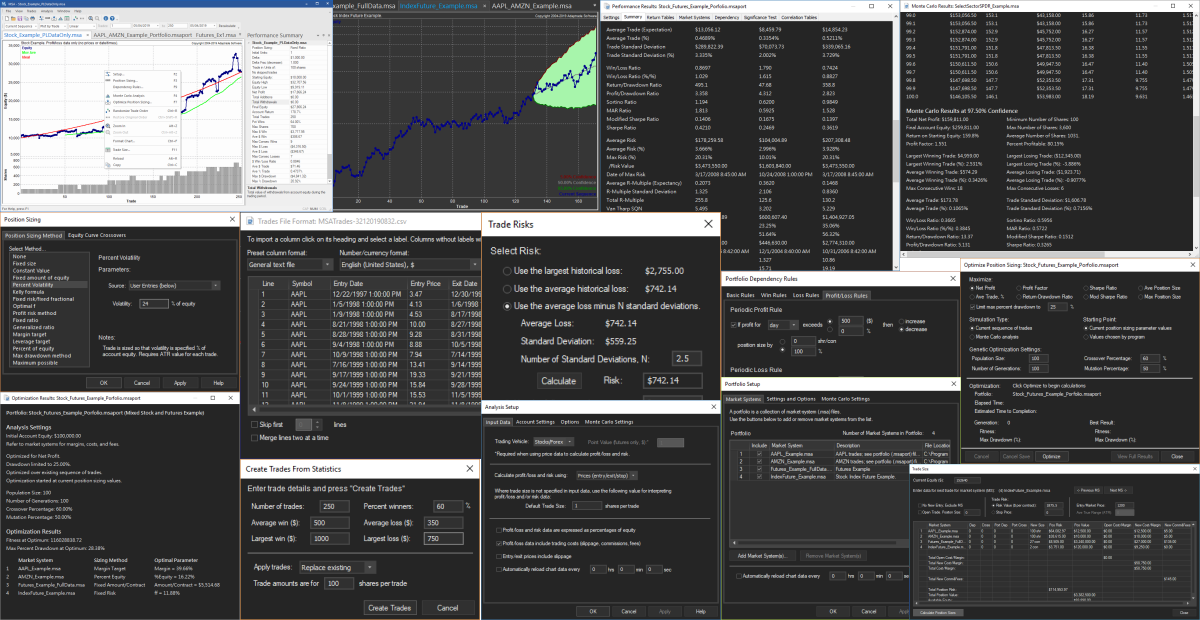

Market System Analyzer (MSA)

Position Sizing and Money Management Software for Trading

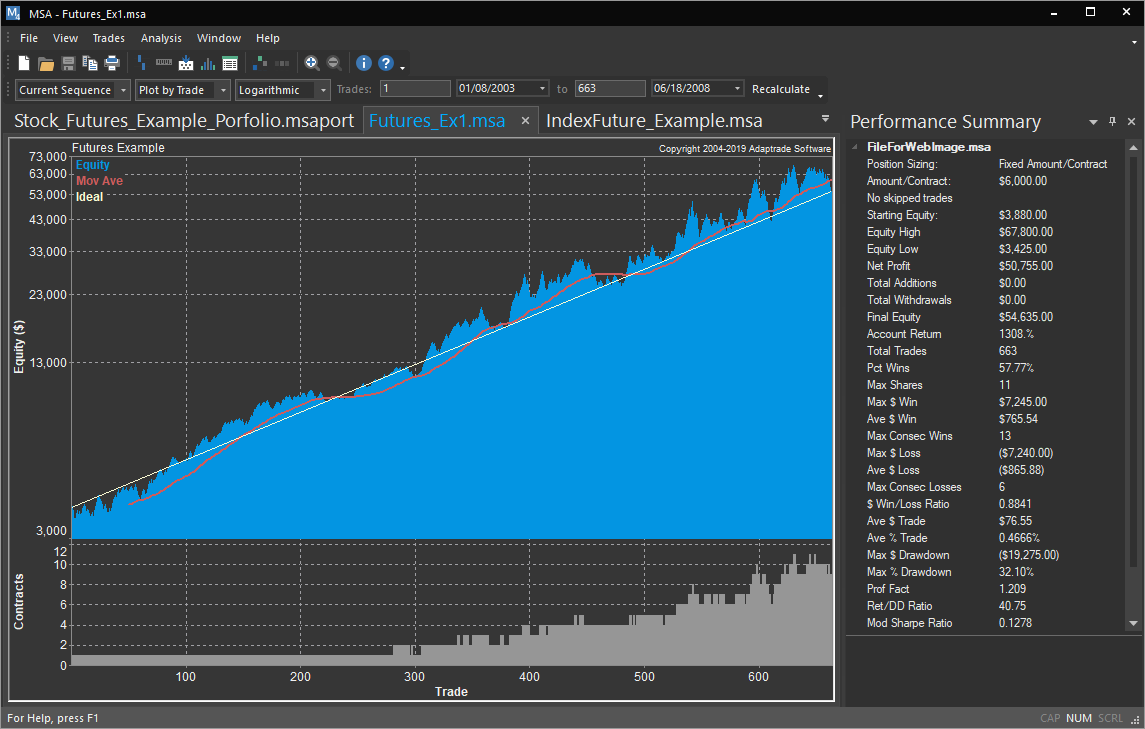

Once you've found an "edge" in the markets – a profitable trading system or method – the greatest opportunity for profit lies with methods for trading your system or method more successfully. These so-called money management methods, such as position sizing, are the core of Market System Analyzer (MSA), a money management software application from Adaptrade Software.

MSA is designed to help maximize the performance of trading systems and discretionary trading methods. MSA can uncover tradable profit/loss patterns, optimize trade sizes, and avoid trades and strategies that have a low likelihood of success. The result is a higher percentage of favorable trades, lower drawdowns, and more consistent returns.

Who Could Benefit From Market System Analyzer?

Any active trader of stocks or futures (commodities futures, currency futures, stock index futures, etc.), whether a day trader or position trader, could benefit from Market System Analyzer. MSA contains a unique combination of analytical tools, including original methods. By combining analysis options you'll discover optimal ways to trade your existing strategies and methods. You can also use MSA to detect when your strategies stop working, saving you money by preventing avoidable losses.

How Could Market System Analyzer Improve Your Trading?

Increase returns and limit risk by trading the right number of shares or contracts for your account size and risk tolerance. Find the optimal position sizing settings to reach your trading goals. Detect over-optimized trading systems and prevent curve-fitting.

Exploit winning and losing streaks. Trade equity curve crossovers four different ways to increase returns and reduce risk. Assess the sensitivity of your trading results to trade order. Evaluate your trading using detailed performance statistics that properly account for position sizing settings and account equity.

Market System Analyzer analyzes "market systems" (e.g., the Euro market traded with a moving average crossover system) in terms of their profit/loss records. The program is designed to extract the maximum amount of information from the minimum amount of input data. And all analysis features in MSA are accessible from simple menu commands, making it easy to perform powerful analyses without any programming and without requiring any market data.

What Do Others Say About Market System Analyzer?

-

“I was using MSA today and am still impressed with what a great product it is.”

B. R., Grand Island, NY

-

“Usually this kind of software is priced 100 times more than MSA and it is reserved to institutional

traders. A powerful tool of MSA is Montecarlo Analysis over the portfolio equity line, this is the

real measure of your “possible” drawdown...”

Dr. Emilio Tomasini, Adjunct Professor of Corporate Finance, University of Bologna, Italy, www.emiliotomasini.com

-

“Thanks for your quick reply, this is the best support service I have ever seen...

MSA is a wonderfull tool, easy and fun to use and reminds me that trading is a money managing game

before all!!”

M. Z., Paris, France

-

"This software is superb! So quick and easy to setup and use. I always think that if you can get the

basics running without spending much time examining the supporting documentation it must be good and

designed with ease of use in mind."

J. N., Godalming, U.K.

-

"Before we found your MSA we were using Rina. Your software is 10 times cheaper and 10 times better!"

T. N., www.financnik.cz

-

"As primarily a discretionary trader, I now have a very powerful ally and tool for helping me to manage

my accounts. Everyone NEEDS this tool, discretionary and mechanical traders alike. Very powerful

introduction to most traders of the advanced money management strategies used by professional traders

and CTA's like myself. "

Jim Harrison, CTA

-

"Great Product!!! I am very impressed!!"

Joe Krutsinger, www.JoeKrut.com

-

"The program’s brilliant, produces just the sort of figures I’m after as a private trader....

Congratulations and thank you for a great piece of tech."

A. C., Auckland, New Zealand

-

"Thank you for all your help. I think I am addicted to your product MSA.

...Thank you creating a great software and keeping us little guys in mind."

Y. C., Lake Grove, NY

-

"As a former fund manager, trading metrics are extremely important to clients as well as back-office

reporting. I think Market Analyzer should be the start and foundation for any serious trading

organization. ...I now use the Market System Analyzer each week to update my own trading records."

M. B., Strongsville, OH, www.mtpredictor.com

-

"I am very pleased with your Market System Analyzer, it is reassuring to be able to test my trading

strategy with this tool."

K. O., San Mateo, CA

-

"against other programs MSA is very easy to use and understandable. my congratulations, and also the

price is unbelievable."

W. H., Toscolano, Italy

-

"Personally I want to THANK YOU for the best software to value on today's market. Money management

analysis are - in my opinion - most important part of any system. And your software works great and

is very simple to use."

M. J., Lake Sherwood, CA

-

"I'm a new user of MSA and very impressed after just a few hrs of use. I've tried doing this myself

in Excel and find your product does an excellent job... Everything I was looking for and more. Thank

you very much!"

D. K., Bristol, RI

Use MSA to Perform Advanced Analyses...

- 15 different position sizing methods so you can increase returns and limit risk by setting the number of shares or contracts based on account size and trading performance.

- Position sizing optimization so you can find the best position sizing settings for your trading goals.

- Monte Carlo analysis with detailed performance reporting to improve your system testing and help prevent curve-fitting.

- Dependency analysis to determine if your trading system or method has a statistically significant tendency to form winning and losing streaks.

- Dependency rules to exploit trade dependency by taking advantage of winning and losing streaks.

- Significance testing to determine if your trading system or method is inherently profitable and to identify over-optimized trading systems.

- Equity curve crossover trading rules to increase returns and reduce risk by modifying your trading based on crossovers of the equity curve with its moving average.

- A randomization feature so you can see how sensitive your trading results are to the original order of the trades.

- A parameter studies feature that helps you find robust ranges of the position sizing parameters.

- Detailed performance statistics to drill down into every aspect of your strategy.

- EasyLanguage™ code for TradeStation™ and MultiCharts that lets you (1) easily transfer your TradeStation strategy results to MSA and (2) add the position sizing methods of MSA to your TradeStation and MultiCharts strategies.

Easily Enter and Manipulate Data...

- Import trade data saved or exported from a variety of trading platforms and other sources. Save the data formatting for later reuse.

- Generate synthetic trade data for testing.

- Specify a trade risk value in one of four ways and assign it to all trades.

- Use the built-in editor to add/edit/delete trade data.

- Export, copy, or print trade data and performance results.

Tailor the Analysis to Your Needs and Preferences...

- Save a segment of data for out-of-sample testing.

- Automatically perform walk-forward position sizing optimization.

- Perform dependency analysis on a walk-forward basis.

- Save analysis reports.

- Format the chart window: change fonts, line and bar colors, grid, title, etc.

Market System Analyzer can be used for several different purposes...

- To test and evaluate trading systems and methods.

- For day to day trading decisions – to decide whether to take an upcoming trade and, if so, how many shares or contracts to trade.

- As an educational tool.

The software is designed for both individual and professional traders. The familiar Windows interface makes the program easy to use, and detailed help files are available if needed to explain how to use each analysis feature. To get started, all you need is a list of trade results for the trading system or method you want to improve.

Still have questions? Try the online FAQ (Frequently Asked Questions).