Detailed Performance Analysis

Market System Analyzer (MSA) is a trading software application that calculates a wide array of performance statistics for trading strategies. The performance statistics in MSA provide a detailed description of your strategy's performance. MSA can be used to evaluate trading systems and methods, optimize trade sizes, perform position sizing calculations on a trade by trade basis, and perform Monte Carlo simulation and other types of analyses.

The performance summaries available in most trading software packages, such as TradeStation,™ are generally based on the assumption that a fixed number of shares/contracts is being traded; e.g., one contract per trade. Performance statistics such as the average trade, largest loss, and drawdown are quoted in dollars. However, when position sizing is incorporated into a trading simulation, the number of contracts or shares tends to increase over time as trading profits accrue.

As the number of shares/contracts increases, so does the drawdown. A drawdown of 10% is $3,000 on a $30,000 account, but if the account grows to $200,000, a 10% drawdown is $20,000. Given the dollar value of the drawdown without the corresponding percentage, is that $20,000 drawdown a 67% drawdown on the starting equity of $30,000 or a 10% drawdown on the same account after it grew to $200,000? The point is that the more important statistic is the percentage drawdown, not the absolute dollar value.

The same is true of the average trade size and a number of other statistics. The solution is to track trading results relative to account equity. That way, regardless of whether the position sizing is based on one contract or the fixed ratio method, the performance statistics will be meaningful and the account size and position sizing will be properly represented. MSA is designed to properly account for position sizing and trading equity to provide a more accurate trading simulation than programs based on a fixed number of shares or contracts.

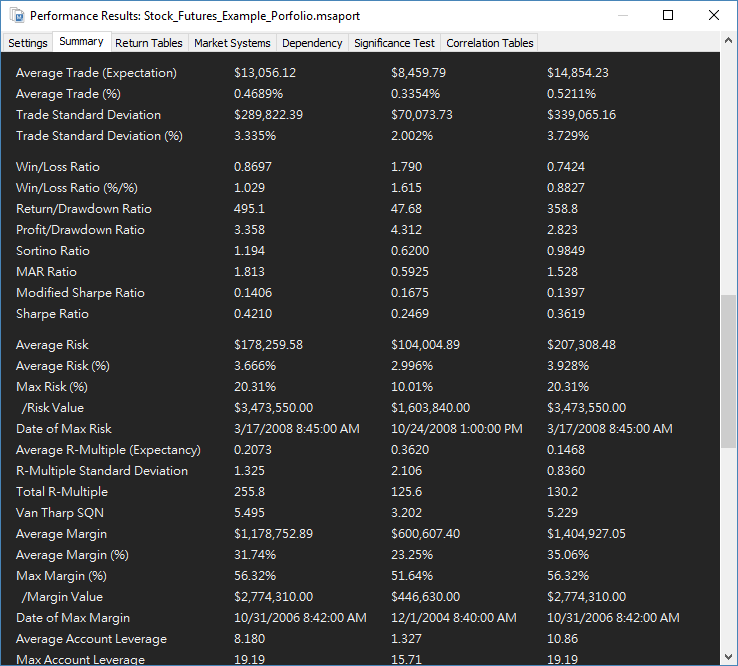

Market System Analyzer provides a detailed list of performance statistics based on account equity and expressed in percentage terms. The statistics are computed for the current sequence of trades, as displayed in the main chart window. If any change is made to the current sequence, such as changing the position sizing method or adding a dependency rule, the performance statistics are automatically updated. The performance statistics can be viewed at any time by selecting Performance Results from the View menu. An example is shown below for a portfolio (equivalent results are displayed for market systems).

The Performance Results window in Market System Analyzer displays the performance results for the current sequence of trades.

The performance results include the following statistics:

Gross Profit

Gross Loss

Total Net Profit

Profit Factor

Pessimistic Return Ratio

Trading Period

Highest Closed Trade Equity

Lowest Closed Trade Equity

Additions to Equity

Withdrawals from Equity

Final Account Equity

Return on Starting Equity

Total Number of Trades

Number of Winning Trades

Number of Losing Trades

Trades Not Taken

Percent Profitable

Max Number of Shares/Contracts

Minimum Number of Shares/Contracts

Average Number of Shares/Contracts

Total Number of Shares/Contracts

Max Number of Open Positions

Average Number of Open Positions

Largest Winning Trade

Largest Winning Trade (%)

Average Winning Trade

Average Winning Trade (%)

Average R-Multiples, Wins

Average Length of Wins

Max Number Consecutive Wins

Largest Losing Trade

Largest Losing Trade (%)

Average Losing Trade

Average Losing Trade (%)

Average R-Multiples, Losses

Average Length of Losses

Max Number Consecutive Losses

Average Trade (Expectation)

Average Trade (%)

Trade Standard Deviation

Trade Standard Deviation (%)

Win/Loss Ratio

Win/Loss Ratio (%/%)

Return/Drawdown Ratio

Profit/Drawdown Ration

Sortino Ratio

MAR Ratio

Modified Sharpe Ratio

Sharpe Ratio

Average Risk

Average Risk (%)

Max Risk (%)

Date of Max Risk

Average R-Multiple (Expectancy)

R-Mulitple Standard Deviation

Total R-Multiple

Van Tharp SQN

Average Margin

Average Margin (%)

Max Margin (%)/Margin Value

Date of Max Margin

Average Account Leverage

Max Account Leverage

Date of Max Account Leverage

Risk of Ruin

Average Annual Profit/loss

Ave Annual Compounded Return

Average Monthly Profit/loss

Ave Monthly Compounded Return

Average Weekly Profit/loss

Ave Weekly Compounded Return

Average Daily Profit/loss

Ave Daily Compounded Return

Number of Closed Trade Drawdowns

Average Drawdown

Average Drawdown (%)

Average Length of Drawdowns

Average Trades in Drawdowns

Worst-case Drawdown

Date at Trough

Trade Number at Trough

Length of Drawdown

Trades in Drawdown

Worst-case Drawdown (%)

Date at Trough

Trade Number at Trough

Length of Drawdown

Trades in Drawdown

Longest Drawdown

Start of Drawdown

End of Drawdown

Percent of Equity of longest drawdown

If desired, the performance statistics can be exported to a text file via the context (right-click) menu. A description of each statistic is provided in the appendix to the help files, which can be accessed by pressing the F1 key.

A subset of these statistics is computed during the Monte Carlo analysis. See Monte Carlo Analysis.

To learn more about Market System Analyzer (MSA), click here.

To learn how Market System Analyzer makes it easy to perform Monte Carlo analysis, click here.