Position Sizing Methods

Market System Analyzer (MSA) is a software application for traders that simulates trading with position sizing. The software is designed to increase returns while limiting risk in existing trading systems and methods. MSA can be used to evaluate trading systems or methods, explore different position sizing options, optimize trade sizes, and perform position sizing calculations on a trade by trade basis.

Position sizing is a money management method for determining the number of shares or contracts to trade. It's an effective risk management strategy that can be used to increase returns, reduce or control risk, improve the risk/return ratio, and smooth the equity curve, among other goals. Market System Analyzer (MSA) is designed to make it easy to apply any one of 15 different position sizing methods. In addition, the optimization feature of MSA combined with its Monte Carlo analyzer can help find the position sizing settings that meet specific trading objectives.

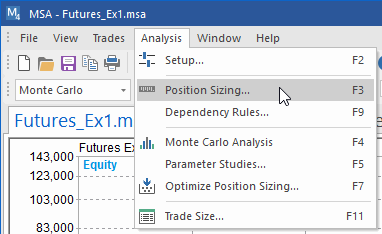

The position sizing window of Market System Analyzer is accessed from the Analysis menu for market systems or via the Portfolio menu for portfolios.

For market-system files, the Analysis menu contains the Position Sizing command.

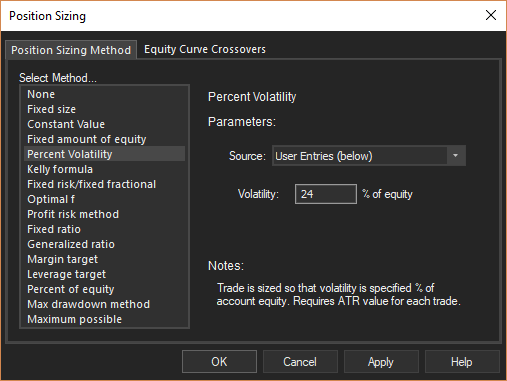

This brings up the Position Sizing window. The position sizing method is chosen from the choices on the Position Sizing Method tab.

The position sizing method is selected from the Position Sizing window.

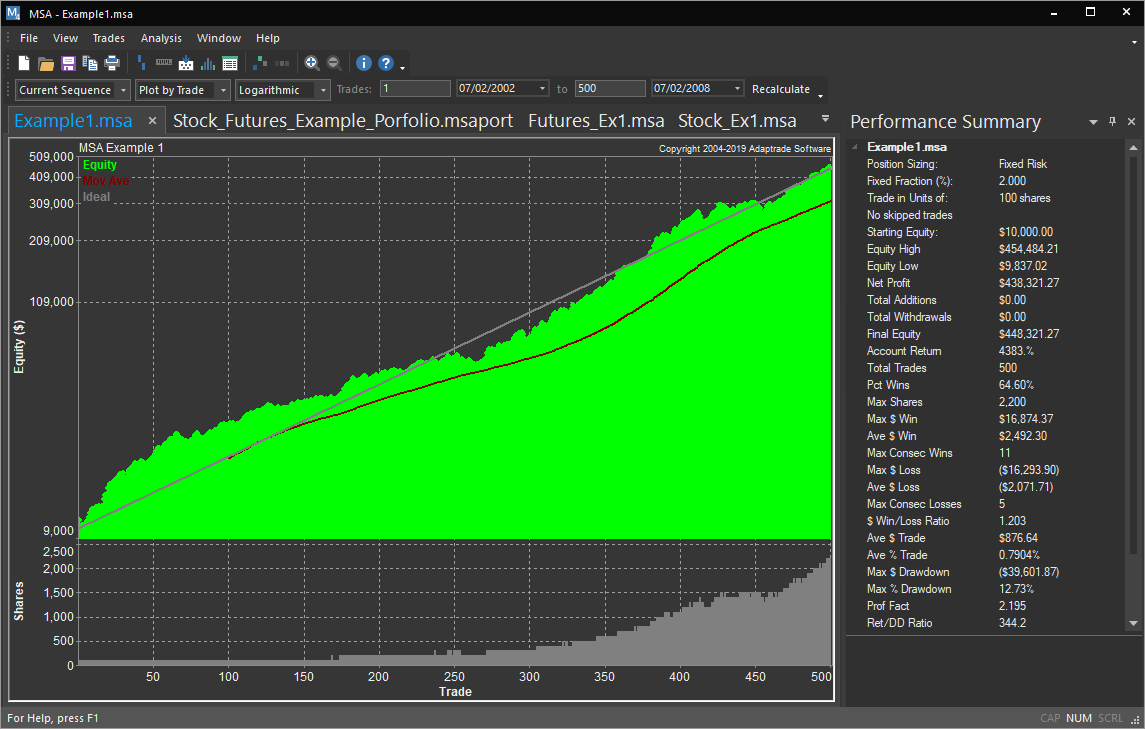

Once a position sizing method is chosen, the main chart in MSA is automatically updated to reflect the chosen method. The main chart displays the equity curve generated from the user's trade history with the chosen position sizing method. An example is shown below.

Main window of Market System Analyzer showing an equity curve with position sizing.

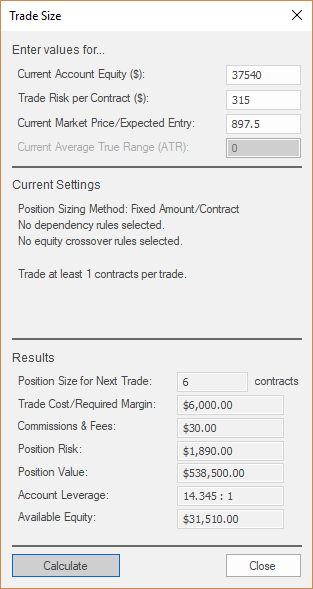

Market System Analyzer can be used as a "position sizing calculator" using the Trade Size command, which opens the window shown below.

The Trade Size window is designed for real-time position sizing calculations or for use as a trade size calculator.

The number of shares or contracts for an upcoming trade can be calculated by entering the current value of account equity and, if applicable, the trade risk, entry price, and average true range (ATR). The number of shares/contracts will be determined from the position sizing method and options currently in effect. An equivalent window is available through the Portfolio menu for portfolios.

To learn more about Market System Analyzer (MSA), click here.

To learn how you can use Market System Analyzer to apply fixed fractional position sizing to your trading, click here.