Fixed Fractional Position Sizing

Market System Analyzer (MSA) is a trading software program that includes fixed fractional (also known as "fixed risk") position sizing. When applied to an existing trading system or method, MSA can help increase returns and reduce risk. The software employs innovative analysis tools to evaluate trading histories, explore different position sizing techniques, optimize trade sizes, and perform position sizing calculations on a trade by trade basis.

The idea behind fixed fractional position sizing is that you base the number of contracts or shares on the risk of the trade. Fixed fractional position sizing is also known as fixed risk position sizing because it risks the same percentage or fraction of account equity on each trade. For example, you might risk 2% of your account equity on each trade (the 2% rule).

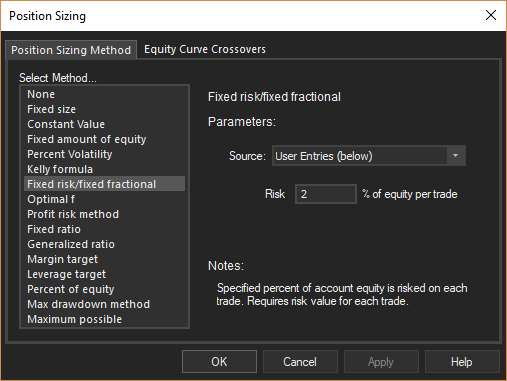

In MSA, fixed fractional position sizing is selected from the choices on the Position Sizing Method tab of the Position Sizing window.

Fixed fractional position sizing is one of 15 different methods available on the Position Sizing window.

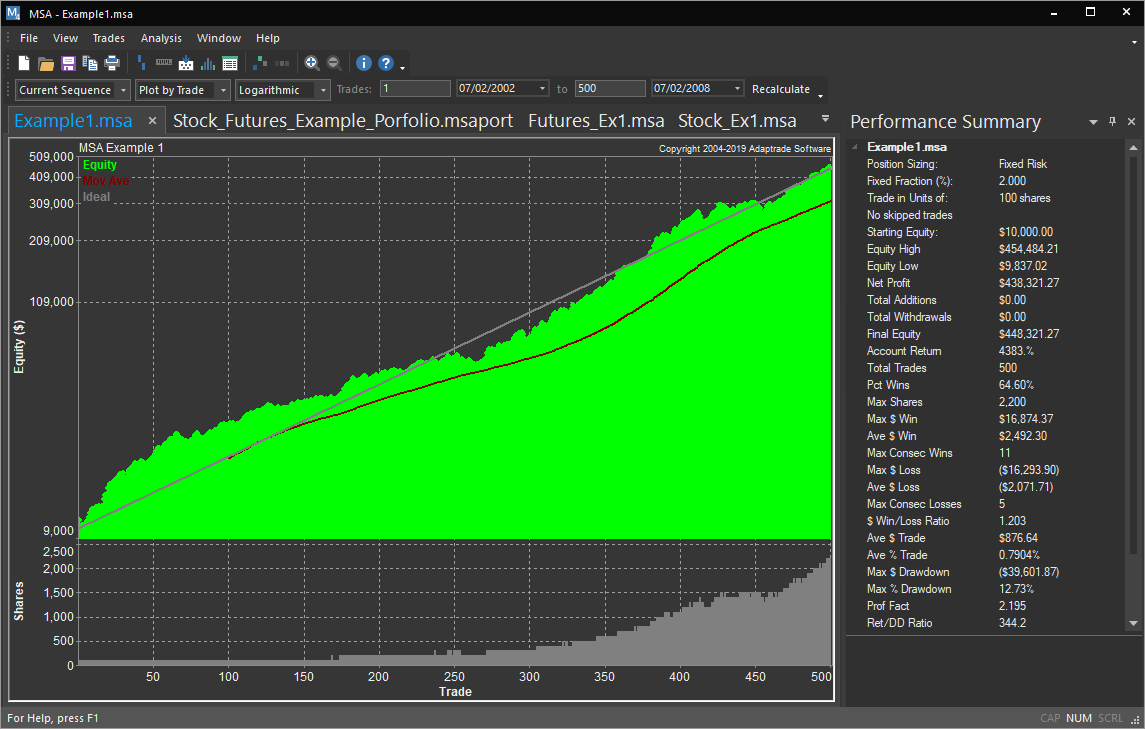

Once the fixed risk method is chosen, the main chart in Market System Analyzer is automatically updated to reflect the position sizing. The main chart displays the equity curve generated from the user's trade history with the chosen position sizing method. An example is shown below.

Main window of Market System Analyzer showing fixed fractional position sizing.

Fixed risk position sizing is related to another method called optimal f position sizing. This is a generalized version of a classic formula called Kelly's formula, which provides the fixed fraction that maximizes the geometric growth rate for a series of trades where all the losses are one size and all the wins are another size. Optimal f position sizing extends the Kelly formula so that the wins and losses can all be different sizes. Optimal f calculates the fixed fraction that maximizes the rate of return for a given series of trades. While this sounds like a good idea, in practice the optimal f value (or the f value from the Kelly formula) often results in drawdowns that are too large for most people to tolerate.

Market System Analyzer includes both optimal f and the Kelly formula as separate position sizing methods.

A less risky alternative to optimal f would be to optimize using Monte Carlo analysis and with a specified limit on the maximum allowable drawdown. This would yield a much smaller and therefore less risky fixed fraction than optimal f.

To learn more about Market System Analyzer (MSA), click here.

To learn how you can use Market System Analyzer to apply another popular method of position sizing to your trading, click here.