Interview: Petr Tmej*

Michael Bryant: Please introduce yourself and tell us how you got started in trading

Petr Tmej: My name is Petr Tmej. I am from Czech republic and I am trading for a living. My studies at university were mainly focused on Probability Theory and Statistical Processes. Shortly after my graduation in 2009 I discovered the world of exchange trading thanks to my friend. I started to build my knowledge by reading numerous books and articles and participating in trading courses in Europe. During this year I had an opportunity to start my PhD studies in Sweden at Linköping University. In addition to my advanced studies of the statistical processes I was more and more fascinated by the unique world of trading. Later in Sweden, I got many friends who focused on trading as well. Therefore I had an opportunity to share a lot of information and knowledge with them. I began to focus on studying automated trading strategies (ATS) mainly for futures markets. It was the best thing I have ever made in my life. Before I was thinking that I would rather be discretionary trader. That time my programming knowledge was very limited. Fortunately soon I found out that I can widely use my knowledge of statistics and theory of probability in trading thanks to the automated trading principles. That would be impossible with discretionary approach.

MB: What about your live trading experience? When did you start and how is it going so far?

PT: Considering my live trading experience I started more than 5 years ago on January 2013. I started with my initial capital $19,625. That year I earned $16,220. After including all the fees for live market data, exchange fees etc. the net profit for 2013 was $14,090 – a return of 71.80%. On November 2013 I had to withdraw $19,060 for my personal purposes. Therefore I started the year 2014 with $14,915. That year I earned $6,524 – a return of 43.7%. After including all the fees for live market data, exchange fees etc., the net profit for 2014 was $3,147 – a return of 21.1%. I traded with automated trading strategies for equity stock indices. Those strategies were generated completely in Adaptrade Builder. Of course for robustness tests I used not only Adaptrade Builder but also TradeStation platform and my own "self-made" robustness tests which are not available in any kind of commercial software. After finishing my first year of trading I was amazed how "easy" trading could be. After the year 2014 I also realized how difficult trading is when it comes to surpass drawdown periods. In the beginning of 2015 I moved from my retail trading with my "personal account" to institutional trading with the QuantOn Solutions project where I am co-founder. I will talk about this project later. It has completely changed the way I trade: First of all we need to have risk under maximum control. It will be the key aspect for our future clients. Considering our live trading experience we started trading in October 2015. From the genetic programming point of view we trade trading strategies for futures markets. We executed literally thousands of trades and earned 29.84% total return from October 2015 till end of September 2018. It means 9.94% p.a. with 19.38% maximum drawdown. We traded many diversified strategies on energies, metals, stock indices and softs. Currentaly we have millions of dollars AUM. As I said we compose the portfolio for having maximum risk under strong control and low margin to equity ratio. So the results are very good and according to our expectations.

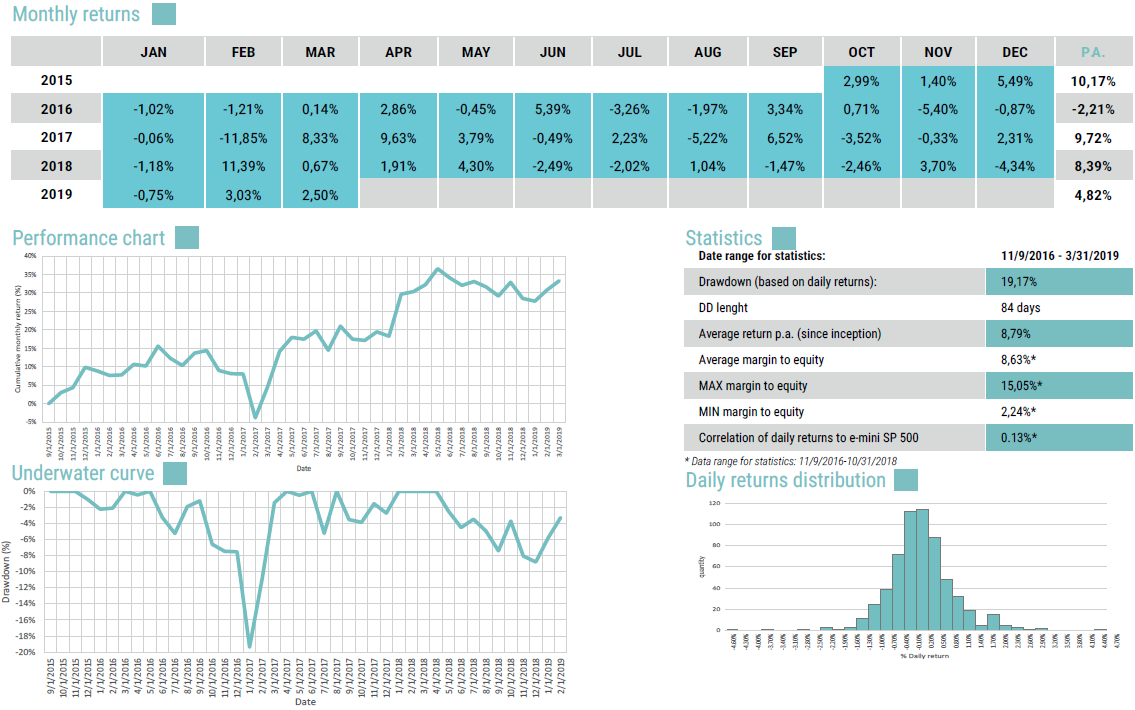

You can see all of my statistics below. If somebody is interested in my account statement, he can contact me to my email address: petr.tmej@aostrading.cz and I will send it by email.

MB: What did your two years of live trading teach you?

PT: I basically realized 3 basic things:- First of all I came to the conclusion that my methods which I use for developing my own trading strategies are viable. My trading strategies executed 391 trades. For me it was the confirmation how important it is to understand the risk of overfitting the trading strategies when you use software for generating thousands of strategies such as Adpatrade Builder and how important it is to eliminate this risk by using the appropriate step by step procedure of advanced statistical robustness tests. Simply said: It is not about being a good programmer. Thanks to tools like Adaptrade Builder you can basically generate unlimited number of trading strategies. Therefore it is much more important to understand Probability Theory and Mathematical Statistics so you can be sure that you know how to identify those strategies which are overfitted. It means that they detect the noise rather than true trading signals with predictive power. I strongly believe that my success is ensured by using Adaptrade Builder, TradeStation and my own self-developed robustness tests which are not available in any commercial platform.

- I also realized how difficult it is to trade with limited capital because of diversification and started to think about the asset under management projects. I don’t say it is impossible to trade few strategies with account in tens thousands of dollars. However I found out that it would be much more efficient to trade diversified portfolio of uncorrelated trading strategies on various types of future markets. That way you can minimize the intensity and length of drawdowns thanks to minimizing the standard deviation of daily revenues.

- I came to conclusion that with my limited trading capital it would be impossible to reach the diversification. Therefore I was very happy that I met my business partners with whom I started the project to become institutional traders – the QuantOn Solutions company.

MB: Tell us something more about your new project from the trading point of view.

PT: As I already said I am co-founder of the QuantOn Solutions company. Our vision is to offer our clients a highly competitive product in the form of a dynamic asset management in the near future. QuantOn Solutions currently acts as R&D company with crucial focus on testing and developing various types of automated trading strategies. Our R&D has two basic approaches:

- Genetic programming approach. We develop long/short intraday and swing strategies for various futures markets by using our own programmed software solution for genetic programming and Adaptrade Builder. During the year 2015 we created the team of traders who are working with Adaptrade Builder and other software tools in order to create the diversified portfolio of trading strategies for various types of futures markets (stock indices, metals, energies, grains). We started live trading with our own investments in September 2015. According to our diversified portfolio back-tested out-of-sample live trading simulations we target double-digit returns expressed as a percentage per year with maximum single digit drawdown. Our main goal is to have the risk under control. That's why we compose the portfolio to have single digit drawdowns.

- Mechanical programming approach. We develop strategies based also on our own ideas and human logic. Last year we developed the stock picking model trading strategies for US stocks. This model uses both fundamental analysis which can be quantified and technical analysis. This automated stock picking model is currently traded with simulated account and we plan to start live trading with this strategy during this year.

MB: Tell us also more about your AOStrading.net project.

PT: This project started in November 2014. My main mission is to provide relevant and necessary knowledge and skills in automated trading systems (ATS) trading to my clients so that they can become successful traders too. I convey my knowledge via articles, conferences, and individual and group courses. My main goal is to explain to my clients that they don’t have to be programmers to be able to create their own ATS thanks to software like Adaptrade Builder. The key is to know how to use Adaptrade Builder in order to eliminate overfitting of trading strategies as much as possible. After educating many clients all around the world I came to conclusion that almost nobody is able to identify over-fitted trading strategies correctly. The articles which are available on the internet are not very comprehensive. In other words the key is to find out which trading systems are viable and which, on the contrary, are not capable of generating profits. It requires a complex filtering process involving employment of sophisticated techniques and methods of statistical data validation.

MB: You've organized a 4 day webinar Building Winning Automated Trading Strategies with TradeStation. Tell us more about it.

PT: During the course I try to impart to my clients my know-how together with a detailed printed manual describing step-by-step creation of long-term profitable automated trading strategies. It means that I teach my clients the exact way how to generate the automated trading strategies in Adaptrade Builder, how to test the robustness of these trading strategies in Adaptrade Builder, TradeStation and also by using my own testing approach and tools which are not available in Adaptrade Builder and TradeStation. I also teach how to create the portfolio of diversified trading strategies and how to manage and monitor them in live trading. Last but not least I also show to my clients how to properly set up live trading to ensure reliable execution of automated trading strategies.

MB: Getting back to Adaptrade Builder, if I understand correctly, you teach your clients your detailed step-by-step process?

PT: Exactly. I teach my approach for generating profitable automated trading strategies. From explaining what kind of date range, bar and time sessions, the ratio of training, test and reserved data are appropriate to use, to the exact set of orders, technical indicators, markets, trading logic and genetic optimization set. The goal is to hand my exact knowledge to my clients. So I do believe that the course would be appropriate not only for the beginners in Adaptrade Builder but also traders who are using Adaptrade Builder both successfully and unsuccessfully and are not sure whether they are using Adaptrade Builder the best way.

MB: What is your plan for AOStrading project for this upcoming year?

PT: On October 2018 there will be a 4 day webinar Building Winning Automated Trading Strategies with TradeStation. The advantage is that the clients who order the course will get immediate access to recordings of the previous courses. On October 2018 the one day webinar Adaptrade Builder Course will take place and it will be focus solely on Adaptrade Builder processes. The difference between the webinars is that Building Winning Automated Trading Strategies with TradeStation is much more comprehensive and show my trading strategies development procedure from the beginning till the end. On the other hand the webinar Adaptrade Builder Course is focused on my step-by-step development procedure only in Adaptrade Builder software.

MB: And my last question: what do you think makes trading profitable in the long run?

PT: I am convinced it is the combination of these three aspects:- Deep knowledge of Probability Theory and Mathematical Statistics in combination with creativity and innovative approach for the trading strategy development process. It sounds quite clear but the opposite is true for majority of traders. If you don't solve correctly the problem with trading strategy over-optimization you can't be successful. Many traders think they consider and understand this problem but according to my experience from my cooperation with them - it is their weakest point.

- Sufficient capitalization and appropriate diversification. It is probably also very problematic. I don't say you can't succeed with trading few trading strategies. On the other the more uncorrelated trading strategies you trade the lower the standard deviation of your daily revenues will be. In other words you will exponentially decrease the length of potential drawdowns. According to our mathematical-statistical models there are trading strategies which have stunning performance and profitability. However, when it comes to worse case scenarios you find out that the length of their drawdown could be years. And still, it doesn't mean that the trading strategy is not viable and profitable in the long run. By using many diversified trading strategies on different markets with different logics you will inevitably decrease the intensity and length of drawdowns. However, we are talking about capitalization in hundreds thousands of dollars. Especially if we talk about futures markets.

-

Money Management. I am sure that a key

aspect of successful trading is appropriate money management. It simply refers

to the algorithm which tells the trader how much money we should allocate to the chosen market with

respect to any particular

position. And I do believe that money management is in fact the synonym for

position sizing. The key of the position sizing is to meet your objectives as a

trader. No matter if you are retail trader who targets 50% return with 25%

maximum drawdown or if you are institutional trader who targets 20% return with 10%

maximum drawdown.

Thanks to

leverage we can adjust to what we really want. The true question is whether our

prediction models are relevant or not. And this is one of the biggest challenges

in trading we have to face every day. If we know how to do it we can win

consistently in the long run. And this is what traders should never

underestimate. Otherwise he will not meet his objective.

MB: Thank you very much. Good luck in your trading and in all your projects.

Thank you.

Disclaimer: Petr is a registered affiliate of Adaptrade Software, and Adaptrade Software is an affiliate of AOSTrading.

* Interview conducted in February 2016 and last updated May 2019.